Summary of Transactions

The Rams have utilized all areas of general management this offseason, and all of these moves have some form of salary cap impact. We’ll detail them below.

Pending Free Agent Extensions: 2

Under Contract Extensions: 2

Signed via Free Agency: 4

Acquired via Trade: 1

Contract Restructures: 1

Lost via Trade: 1

Lost via Retirement: 1

Outright Releases: 1

Lost via Free Agency: 9

2022 SALARY CAP IMPACT

| TRANSACTIONS | ‘22 CAP IMPACT | NET CHANGE |

|---|---|---|

| 4 Free Agent Signings 2 Pending Free Agent Extensions 8 Signed Draft Picks |

$15.14M | $15.14M |

| 3 Under Contract Extensions | -$13.125M | $2.015M |

| 2 Trades (1 in, 1 out) | -$1.3M | $715k |

| 1 Outright Release | -$2.05M | -$1.335M |

| 1 Retirement | -$15.5M | -$16.835M |

| 1 Restructure | -$12M | -$28.835M |

In other words, the Rams added or brought back 15 players, moved on from 3 under contract (trade, retirement, release), and by extending three notable players (Donald/Stafford/Kupp) and restructuring another (Floyd), came away with over $28M of additional cap space in 2022.

New Starters

Using the projected depth chart from Ourlads, here’s a breakdown of potential starting roles that have been replaced for the upcoming 2022 season.

WR Allen Robinson (trade) replaces Odell Beckham Jr. (free agency)/Robert Woods (trade)

OL Joe Noteboom (internal) replaces LT Andrew Whitworth (retirement, pending)

OG Logan Bruss (draft) replaces Austin Corbett (free agency)

LB Justin Hollins (internal) replaces Von Miller (free agency)

LB Bobby Wagner (free agency) replaces Troy Reeder (free agency)

P Riley Dixon (free agency) replaces Johnny Hekker (release)

KR Brandon Powell (free agency) replaces Cooper Kupp/Ben Skowronek

Pending Free Agent Extensions ($5.3M)

New contracts for a few offensive lineman before they hit the open market added $5.3M of cap to the Rams’ table this past March.

March 14th

Extended C Brian Allen 3 years, $18M with $10M guaranteed through 2023.

2022 Cap Charge: $1.8M

March 14th

Extended new LT Joe Noteboom 3 years, $40M with $25M guaranteed through 2023.

2022 Cap Charge: $3.5M

Under Contract Extensions

The Rams freed up $12.25M of cap space in restructuring/extended massive contracts with their franchise QB and defensive weapon.

March 19th

Extended QB Matthew Stafford 4 years, $160M with $130M guaranteed through 2025.

2022 Cap Charge: $13.5M ($9.5M saved)

June 6th

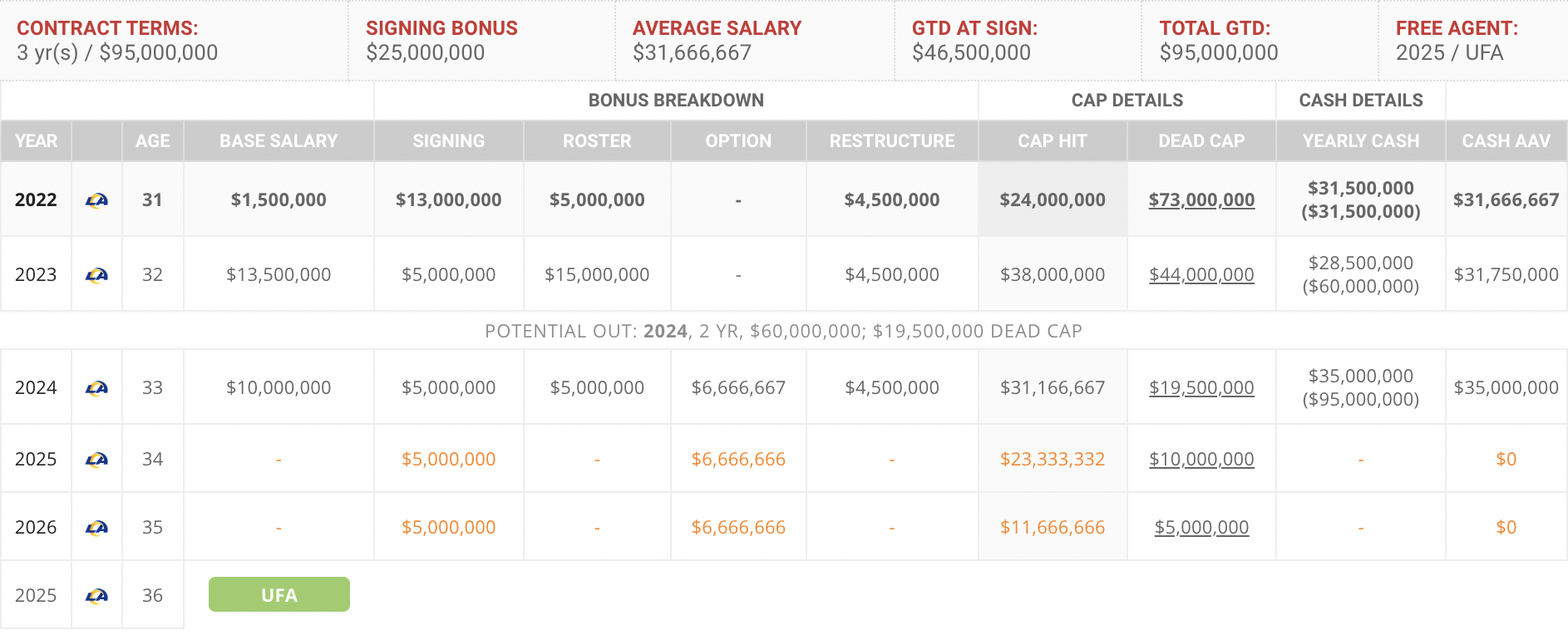

Extended DL Aaron Donald 3 years, $95M with $65M guaranteed through 2023.

2022 Cap Charge: $24M ($2.75M saved)

June 8th

Extended WR Cooper Kupp 3 years, $80.1M with $75M guaranteed through 2023.

2022 Cap Charge: $17.8M ($875k saved)

Trades

LA surprised many when they moved on from Robert Woods, and surprised nobody when they brought back Troy Hill. They netted $1.3M of cap with these moves.

March 19th

Traded WR Robert Woods to Tennessee, taking on an $11.9M dead cap hit.

2022 Cap Savings: $3.8M

April 30th

Acquired CB Troy Hill from the Browns on a 1 year $4.5M contract, converting $3M to bonus.

2022 Cap Charge: $2.5M

Free Agents

The Rams added 4 projected starters in free agency this spring. They combine for just $8.5M of 2022 cap this season.

March 17th

Signed WR Allen Robinson 3 years, $46.5M with $30.75M guaranteed through 2023.

2022 Cap Charge: $4.3M

March 19th

Signed KR Brandon Powell, 1 year, $1M

2022 Cap Charge: $895,000

March 31st

Signed LB Bobby Wagner 5 years, $50M with $20M guaranteed through 2024.

2022 Cap Charge: $2.5M

April 5th

Signed P Riley Dixon to a 1 year, $1M contract

2022 Cap Charge: $895,000

Releases

After a run of Pro Bowl caliber seasons, LAR moved on from their starting punter. It freed up $2M of cap space, and they went on to replace him with Riley Dixon’s $895k charge.

March 15th

Released P Johnny Hekker, taking on a $942,000 dead cap hit.

2022 Cap Savings: $2.05M

Restructures

The single contract conversion of the offseason (thus far) opened up $12M of much needed space at the start of free agency.

March 16th

Restructured LB Leonard Floyd’s contract

2022 Cap Savings: $12M

Draft Picks

The Rams have 8 players under contract from the 2022 NFL Draft, starting with pick #104.

2022 Top 51 Draft Pool: $1.25M

Retirement (assumed)

LT Andrew Whitworth retires, leaving behind a $2.16M dead cap hit for 2022, $2M for 2023.

2022 Cap Savings: $15.5M

Additional Dead Cap

In addition to the dead cap hits mentioned above, the Rams hold $680,000 of dead cap from moves made both in 2021 and this offseason thus far.

2022 Cap Charge: $680,000

Still To Come

Starting LG David Edwards, RT Rob Havenstein DT Greg Gaine, DE A’Shawn Robinson, FS Nick Scott, CB David Long and K Matt Gay are all in contract years. Do the Rams strike early on any of these extensions?

But What About 2023...

Now we're talking. Anyone who follows the business of the NFL closely knows that a move made today almost always mean more pain tomorrow. As it currently stands, the 2023 Rams have 62 players under contract with $240M of cap allocated. If we project a $218M league salary cap, this means we estimated LAR to be about $12M over right now from a Top 51 standpoint, $22M in total allocations.

Aaron Donald + Matthew Stafford + Jalen Ramsey + Leonard Floyd currently = $105M of 2023 salary cap.

The good news? All of that cap is just as flexible as the 2022 figures were. And Les Snead can wave his magic wand and do the above all over again. Rinse, Repeat, Rinse, Repeat...until they're bad.